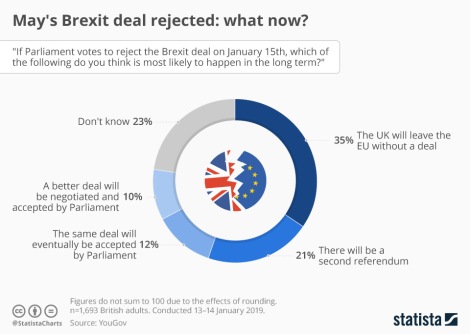

The parliament tragedy of the EU/UK agreement ratification increased the uncertainty related to the Brexit with bigger odds to see a no deal scenario soon, which most of the (wise) observers have always been describing as a catastrophic outcome of the process. In case of no deal exit, trade between EU countries and the UK would be regulated on the basis of the WTO principles and the so-called Most Favored Nation tariffs would be applied. This would result in an application of duties that would be particularly detrimental to trade, especially because many intermediate goods cross the Channel several times in the same production process.

Lot of fog in the Channel apparently…

The estimated impact of Brexit will be much greater for the UK than for the EU and will depend on whether or not an agreement is reached between the two parties. For the United Kingdom, the Bank of England estimates a fall in GDP of up to 8% within one year of the exit (in the event that UK does not even enjoy the EU’s trade agreements with third countries anymore), with a progressive fall of 30% in property prices and almost a 2X increase in the unemployment rate. A further analysis by the National Institute of Economic and Social Research estimates an annual loss of 5.5% of GDP in the case of hard brexit, in the case most of the already signed agreements will be kept alive.

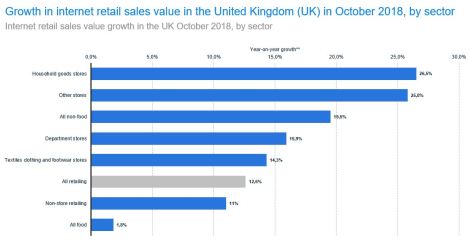

Online retail sales growth by sector, according to UK official stats

Forbes recently published a very interesting interview on the impact of Brexit in the British e-commerce market, which among other things is the third largest market in the world in terms of online sales for the retail channel, driving the worldwide development of -commerce with China and United States. An in-depth study with the EMOTA association (which deals with cross-channel trade in Europe), which shares important concerns in the event that interruptions in cross-channel trade occur because all products will have to go through controls and compliance procedures that will slow down sales. Consumers waiting for their parcels to be delivered, with some categories of products that have yield rates of up to 50% which are typical of advanced digital markets (in other countries that lag behind in terms of online sales, return rates are still “shy” and low), would be a clear signal of e-commerce slowing down.

(Photo by Thomas Charters on Unsplash)

According to the IMRG MetaPack UK Delivery Index, orders from UK retailers increased a few months after the Brexit referendum due to the drop in GBP compared to other currencies. But the most recent data published in December 2018 indicate that the slowdown in online retail sales is a realistic fear. A fear that British marketplaces and retailers will face opening logistics centers in the continent, if their shoulders are strong enough, but that will hit especially the less structured players that will have a bad time and suffer the international competitor (like China).

(Photo by Sabrina Mazzeo on Unsplash)

Header photo by Luke Stackpoole on Unsplash