Fingerprints to unlock the payment, a balance just a tap away on your smartphone, a smooth sign up process, and possibly an infrastructure that allows you to pay on the fly by placing your smartphone on the POS. These are the simple key features of an effective mobile payment system, in a competitive race that has long heated up spirits among the various Google Pay, Apple Pay, Samsung Pay and so on. The share of digital and mobile payments is growing exponentially, following the destiny of e-commerce and the transition to a new retail era where offline and online merge continuously. Having a relevant share of mobile payments means to be able to control the enormous amount of data on purchases and financial management on the consumer side. A delicious cake that few tech giants and financial startup can miss.

Contactless … already a step ahead, especially with Square (Unsplash photo)

The example is China: light years ahead of the Western world, transformed a country without credit cards into a duopoly between Alipay, Alibaba Group’s mobile digital wallet payment system, and WeChat pay, which managed to achieve a relevant market share handling half of the electronic payments in the country with a billion transactions a day. In HeMa supermarkets in Shanghai you pay with your smartphone and even homeless people on the street ask for spare change showing a QR code associated with their digital wallet, while groups of friends share the restaurant bill with a few taps on their favorite social network .

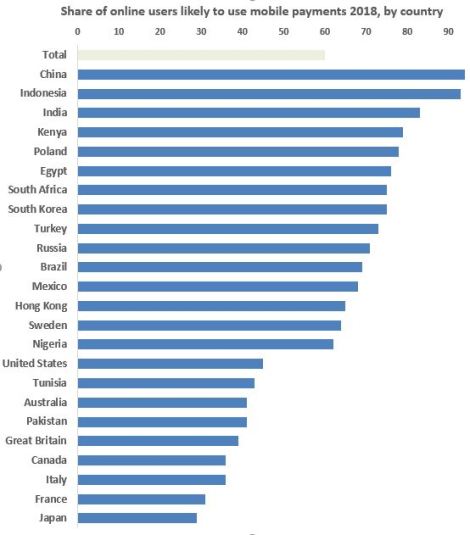

The rest of the world is lagging behind…but the latest IPSOS data show that there are several high-growth and e-commerce markets, such as China, India, Indonesia and many others, where the propensity to use of digital payment systems is close to Bulgarian percentages.

Share of users who declare themselves, according to IPSOS, inclined to use mobile digital payment

If we look at the platforms globally by number of users, the distribution is obviously China-centric, but on the western side we have an unprecedented distribution in which new, more versatile instruments of the past have finally appeared on the market.

The main mobile payment apps…by user base

And the United States? It’s interesting to dive into the main trends in the US, the second e-commerce market in the world and, above all, one of the most important retail markets both for the traditional large distribution molochs and for the disruptive positions of Amazon Go and other players. A good observer to keep an eye on is obviously the US Payments Forum and its papers on the topic. Interesting to see them complaining for a slow implementation of the technologies that support digital wallet payments since, in May 2011, Google introduced its system that uses NFC and smartphones to finalize electronic payments. Yet it indicates seven lessons or case histories from which to take inspiration, of which three are certainly to keep in mind:

- starbucksStarbucks has the highest rate of wallet payment in the United States, reaching 30%

- Apple Pay has a scratch monopoly as it covers 90% of the country’s mobile and contactless transactions

- Walmart Pay has succeeded in just twelve months since the adoption to equal and almost surpass the wallets that rely on individual devices. Maybe consumer incentives work definitely well if paired with customer loyalty programs.

Hence the operational and pragmatic indications: we need systems that can focus on an easy and intuitive customer experience, give trust and security, and avoid POS or hardware changes and above all do not require additional fees. Shortcomings in these features have led to the worst stories of failure in the industry, such as CurrentC or others.

Gotta run, but carefully!